While more and more consumers are choosing to use credit and debit cards as opposed to checks, you should still have the ability to accept Electronic Check Service so you don’t miss a sales opportunity. To keep your check processing simple, you can choose an eCheck processing service from Targeted Merchant Solutions.

Electronic Check Service

[vc_custom_heading text=”E-Check Processing” font_container=”tag:h2|font_size:32|text_align:left” google_fonts=”font_family:Playfair%20Display%3Aregular%2Citalic%2C700%2C700italic%2C900%2C900italic|font_style:400%20regular%3A400%3Anormal”]

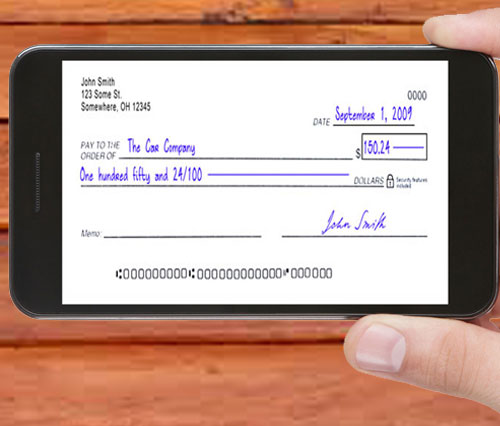

[vc_custom_heading text=”What Is An Electronic Check?” font_container=”tag:h2|font_size:32|text_align:left” google_fonts=”font_family:Playfair%20Display%3Aregular%2Citalic%2C700%2C700italic%2C900%2C900italic|font_style:400%20regular%3A400%3Anormal”][vc_toggle title=”An electronic check, also known as an echeck, electronic check conversion, or Back Office Conversion (BOC),is an electronic version of a paper check. An electronic check allows a merchant to convert paper check payments into electronic payments that are processed through the Automated Clearing House (ACH) Network.” css_animation=”top-to-bottom” custom_font_container=”tag:p|text_align:left” custom_use_theme_fonts=”yes” el_id=”1478808140678-62277cf2-0821″ use_custom_heading=”true”]This means it’s a faster, more efficient and secure method for processing checks.[/vc_toggle]

[vc_custom_heading text=”How eChecks Work?” font_container=”tag:h2|font_size:32|text_align:left” google_fonts=”font_family:Playfair%20Display%3Aregular%2Citalic%2C700%2C700italic%2C900%2C900italic|font_style:400%20regular%3A400%3Anormal”][vc_toggle title=”Electronic check conversion is a convenient method for processing payments, and the changes to how you conduct business are minimal. One of the biggest advantages of this method is that you can electronically submit checks instead of having to physically take them to the bank, which saves you time and increases employee efficiency.” css_animation=”top-to-bottom” custom_font_container=”tag:p|text_align:left” custom_use_theme_fonts=”yes” el_id=”1479402540400-f68afa17-32ff” use_custom_heading=”true”]When you receive a paper check payment from a customer, you put the check through the electronic scanner system from Targeted Merchant Solutions. From here the customer’s banking information is captured as well as the payment amount written on the check. The information is then electronically transferred via the Federal Reserve Bank’s ACH Network, which takes the funds from your customer’s bank account and deposits them to yours.

Once the eCheck has been processed and approved, the terminal will print a receipt for the customer to sign and keep. You cna then mark the paper check as “void” and return it to the customer. The process is smooth and simple so you can keep your business as organized as possible.[/vc_toggle]

[vc_custom_heading text=”Benefits of eCheck Processing” font_container=”tag:h2|font_size:32|text_align:left” google_fonts=”font_family:Playfair%20Display%3Aregular%2Citalic%2C700%2C700italic%2C900%2C900italic|font_style:400%20regular%3A400%3Anormal”][vc_toggle title=”Reduced processing costs” css_animation=”top-to-bottom” custom_font_container=”tag:p|text_align:left” custom_use_theme_fonts=”yes” el_id=”1478808296923-c6b27b1e-89cb” use_custom_heading=”true”]The cost to process an eCheck is much less than that of paper check processing or credit card transactions because eChecks use less manpower to process and eliminate incidental costs including deposit and transaction fees that come with paper checks. You can save up to 60% in processing fees with eChecks.[/vc_toggle][vc_toggle title=”Increased sales” css_animation=”top-to-bottom” custom_font_container=”tag:p|text_align:left” custom_use_theme_fonts=”yes” el_id=”1478808378857-19f7ea7e-57ab” use_custom_heading=”true”]If your company didn’t previously accept paper checks, you can expand the payment options available to your customers by offering eChecks. If you are converting from paper checks to eChecks, you can also expand your customer base with the ability to accept international and out-of-state checks without the risk of fraud; eChecks require account validation and consumer authentication processes that will identify bad checks immediately.[/vc_toggle][vc_toggle title=”Funds are received sooner” css_animation=”top-to-bottom” custom_font_container=”tag:p|text_align:left” custom_use_theme_fonts=”yes” el_id=”1478808404363-fe9ac1b0-3789″ use_custom_heading=”true”]When businesses use electronic check conversion, they have funds deposited nearly twice as fast as others using traditional check processing methods, with billing companies typically receiving payments within 1 day.[/vc_toggle][vc_toggle title=”Simple, safe & smart” css_animation=”top-to-bottom” custom_font_container=”tag:p|text_align:left” custom_use_theme_fonts=”yes” el_id=”1478808427333-4598a278-8b81″ use_custom_heading=”true”]eCheck conversion is simple to set up and relies on the ACH Network for processing (the same trusted funds transfer system that handles Direct Deposit and Direct Payment). eChecks are also a smart choice for the environment, reducing fuel use and greenhouse gas emissions created by transporting paper checks.[/vc_toggle][vc_toggle title=”Fewer errors & reduced fraud” css_animation=”top-to-bottom” custom_font_container=”tag:p|text_align:left” custom_use_theme_fonts=”yes” el_id=”1478808457003-fc28b0dc-2790″ use_custom_heading=”true”]Electronic checks are processed using an automated system, cutting down the number of people needed to handle the check, which reduces potential for error or fraud. Targeted Merchant Solutions will maintain, monitor, and check files against negative account databases that store information about individuals and companies that have records of fraud, decreasing overall fraudulent activity.[/vc_toggle]